The 30th anniversary of Hurricane Andrew’s assault on South Florida is days away, and for the uninitiated and those who may have forgotten, here is what the Category 5 storm did to southern Miami-Dade County and elsewhere.

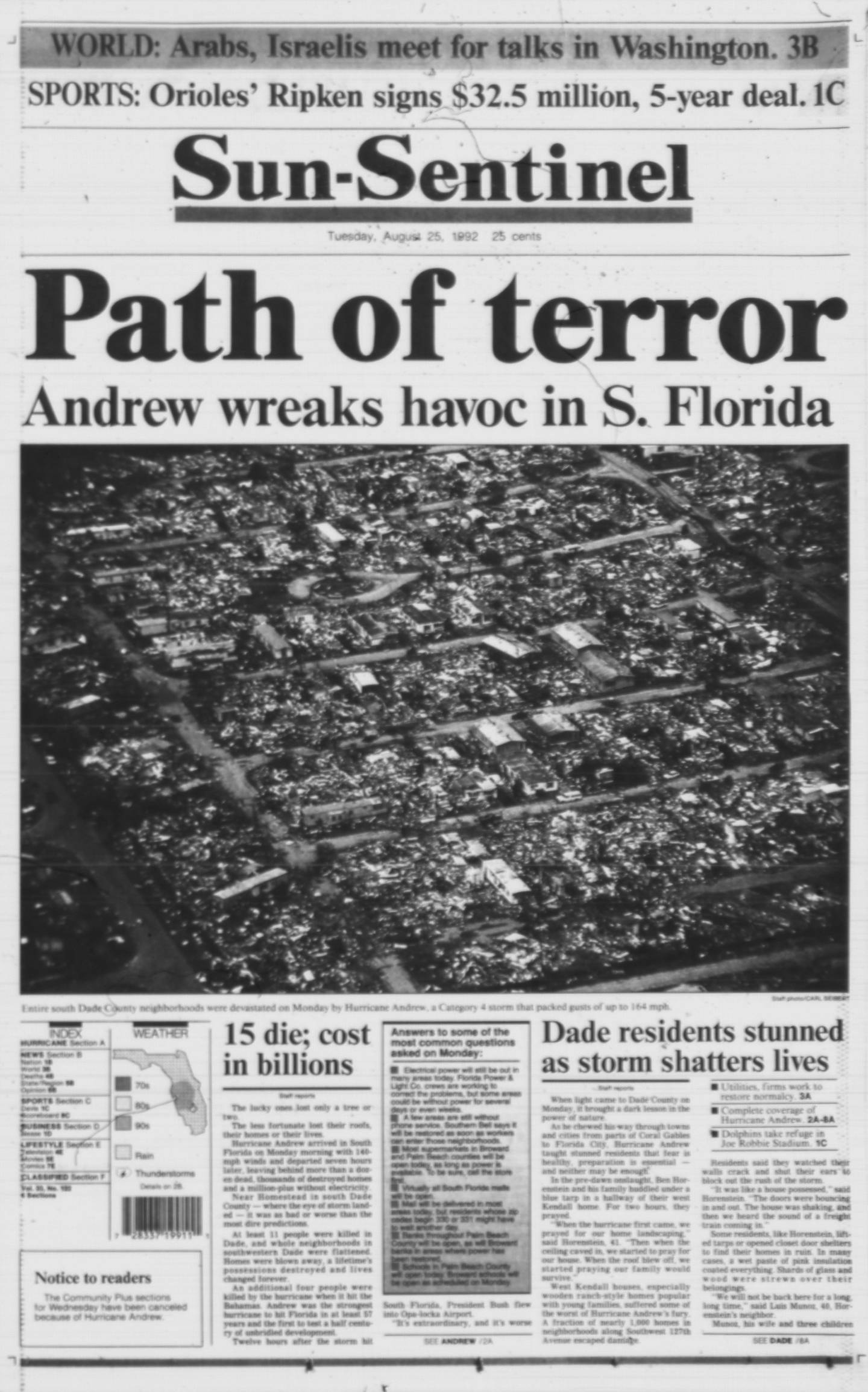

After striking on Aug. 24, 1992, Andrew killed 65 people, destroyed 63,000 homes, left 175,000 homeless, and in the immediate aftermath, left a million people without power. Three cities and towns in particular — Homestead, Florida City and Naranja Lakes — were completely or nearly reduced to ruins.

When 100 Air Force reservists returned home from temporary duty in Italy, their C-141 Starlifter landed at the U.S. Coast Guard station at Opa Locka Airport in northern Miami-Dade, not at their headquarters at Homestead Air Force Base, which bore the earmarks of a military attack.

“Welcome back,” Col. Russell Clem told the returnees. “Unfortunately, I have to say, welcome back to the greatest natural disaster to hit the United States.”

By many accounts, the recovery effort that followed was chaotic and nearly devoid of leadership. But once the extent of the disaster became apparent, a region that was already battered by a recession, a savings-and-loan crisis, elevated joblessness, and the bankruptcies of leading employers gradually found its way back.

If Andrew did the region any favors, it exposed flaws in local building codes, shoddy construction on a large scale, the pitfalls of relying on an economy focused on tourism and real estate, and deficits in storm preparation and recovery.

How resilient is South Florida now?

Interviews this week with businessmen, economists, forecasters and other experts show substantial improvements over the last three decades. Many agree that another storm of Andrew’s magnitude is likely to be mitigated by preventive measures taken over the years, though South Florida’s growing status as a preferred place for out-of-staters to relocate has raised uncertainties about the extent of damages another massive storm could cause.

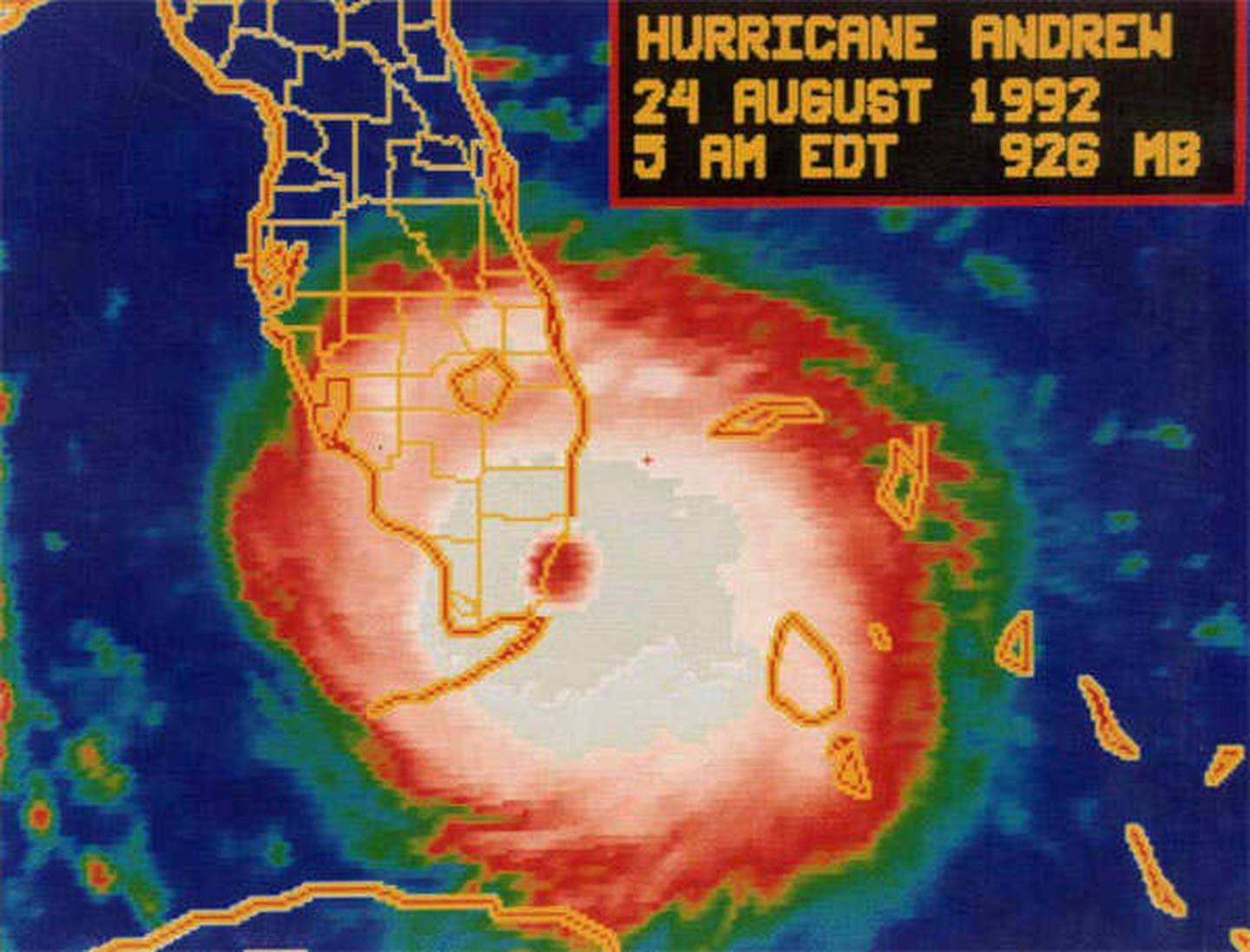

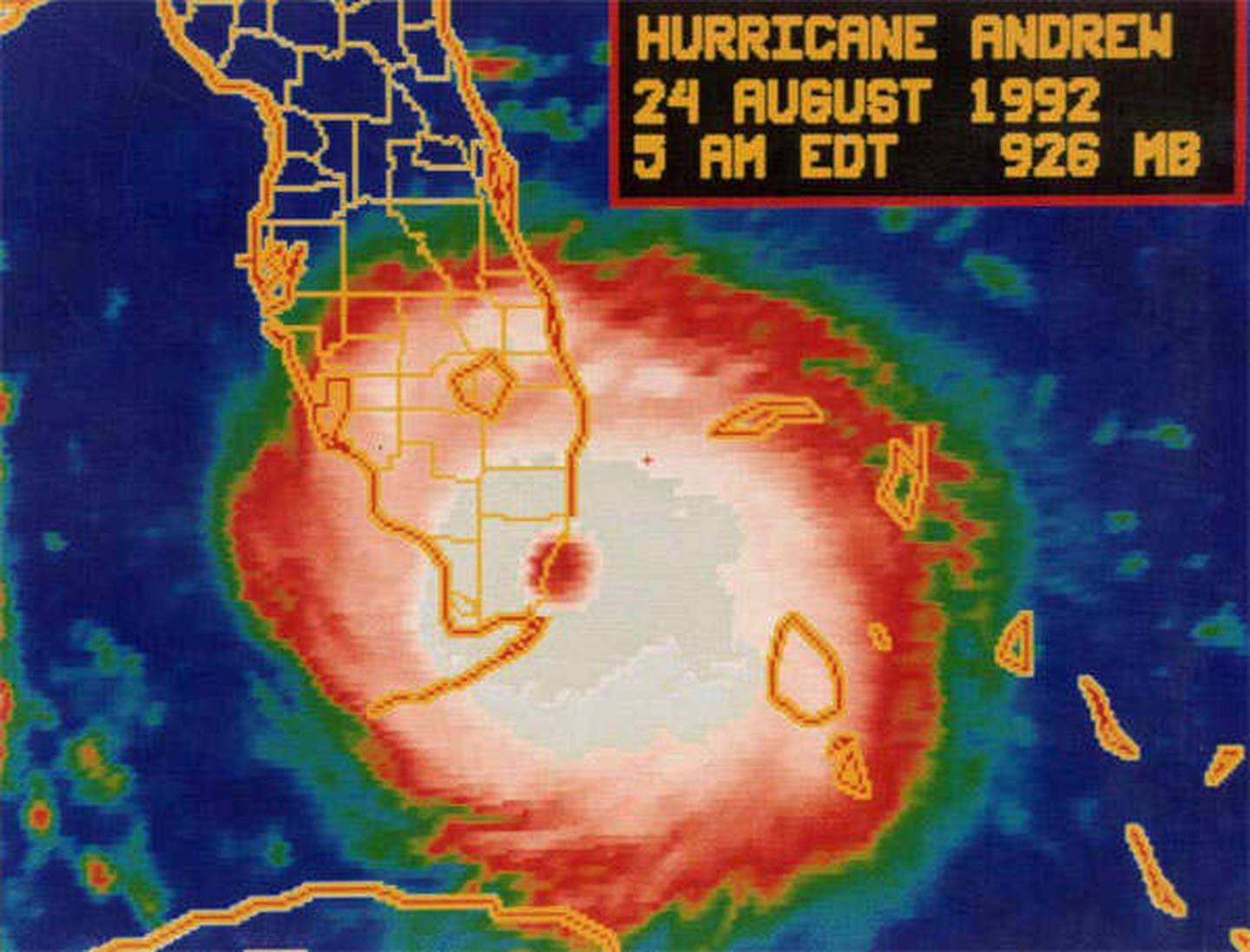

Hurricane Andrew, one of the most powerful storms of the 20th Century, as it hit the southeast coast of Florida on Aug. 24, 1992.

New building codes

The communities of South Miami-Dade never had a chance in the face of a storm packing wind speeds of 175 mph and higher in certain areas.

Mobile home parks were reduced to shards of wood and metal. Planes, hangars and housing at the air base suffered heavy damage. Some housing developments stood fast better than others, their fates tied to building code adherence, construction quality and their proximity to the severest winds.

Broward and Palm Beach counties got their share of high winds, downed trees and structural damage, but the impact was greatest the farther south one drove.

The storm destroyed or damaged more than half of Miami-Dade’s housing units, according to a 1996 University of Florida research report. More than 353,000 people evacuated their homes, according to the university’s Bureau of Economic and Business Research.

Two Miami-Dade grand juries investigated deficiencies in both the codes and their enforcement, and strongly urged improvements. Today those improvements are a factor that many in the construction and weather forecasting businesses view as the region’s main line of defense against future big storms.

Bryan Norcross, FOX weather contributor and hurricane specialist, was working for WTVJ-Ch. 6 in Miami when Andrew struck. He was on the air for 23 consecutive hours, sitting down in his anchor chair at 9 a.m. Sunday; he didn’t leave until 8 a.m. Monday.

Norcross is credited with comforting thousands of South Floridians during the worst of the storm because they heard his voice on the radio. They heard him on the radio only because he made preparations to have a radio feed in case the TV transmission didn’t work.

“A sequence of things that happened allowed my voice to be the voice they heard in the dark of night when all hell was breaking loose,” he said.

His main Andrew takeaway: better building codes.

“The building codes used in Dade and Broward county are the best hurricane building codes in the world. It’s a direct result of Hurricane Andrew,” he said.

Miami construction law attorney George Breur of the Mark Migdal and Hayden firm says the post-Andrew codes are responsible for reduced damages across Florida during subsequent storms in the 2000s.

“Andrew was basically what gave birth to the Florida building code,” he said. “There was obviously inconsistent enforcement of the codes. Every three years it’s been updated and improved.”

In Miami. he said, 25 new condo towers are under construction and all of them will contain high-impact glass materials.

“In Miami-Dade County a residential high-rise has to have a wind grade of over 185 mph,” Breur said. “That’s not to say we’re not going to have some damage. But the key takeaway is that losses will be reduced. You’re not going to have a building blown completely away and there should be less insurance claims.”

Aerial of a Florida City mobile home park in 1992 after Hurricane Andrew devastated south Miami-Dade (then just Dade) County. The old Florida City water tower took a beating and was replaced by a new tower. The city’s water plant was also refurbished. (Carl Seibert/South Florida Sun Sentinel file)

But construction these days is more costly.

Ron Magill, Zoo Miami’s goodwill ambassador and communications director, recalled the zoo’s aviary was destroyed, causing the loss of countless birds.

“What has changed is that the building codes became so much more stringent following the hurricane,” Magill said. “An aviary that originally cost us $3 million to build, to rebuild [it] to meet the codes properly took us 10 years at a cost of $13 million.”

Management hopes the strengthened codes will help prevent animal escapes and reduce the chances for injuries.

Peter Dyga, president and CEO at Associated Builders & Contractors, Florida East Coast chapter, warns the code improvements are no guarantee against widespread damages even though he lauds the upgrades.

“For sure I think the changes that were put in place contributed to progress through the years to the point where we have one of, if not the strongest building codes in the world.”

As a result, the level of destruction “should not should be as great” if the region was hit by another storm of Andrew’s strength.

But he warned the better code doesn’t make the region risk-free.

“We will probably be hit by the same things again,” he said. “We are taking a calculated risk by having people living in a zone that’s exposed like the southeastern portion of Florida.”

A diversified economy: a stronger defense?

South Florida’s economy is in better shape now than 30 years ago to withstand the financial impact of severe storms, economists say.

J. Antonio Villamil is the founder and principal adviser at Washington Economics Group, a consultancy in Coral Gables, and a former undersecretary of commerce In the 1990s during the administration of President George H.W. Bush.

“We’re a different economy altogether,” he said. “We have much more international business and high technology startups. We don’t rely as much as we did before on cyclical construction and tourism as in the past. Given the size of the population and entrepreneurial nature of the startups, it’s quite different than during Andrew.”

amra Giffen looks through what is left of her mobile home in Kendall on Aug. 25, 1992, after Hurricane Andrew hit South Florida. (Jim Virga/South Florida Sun Sentinel file)

Immediately after the storm, a recovery movement spearheaded by private businesses called “We Will Rebuild” helped jump-start the process and set a tone for more cooperation between the public and private sectors..

“It helps to create a better business environment when you have the public sector and business community working toward a common goal,” Villamil said. “That happened. There was a lot of leadership in the area.”

“We Will Rebuild was a major factor in driving investment in the area,” he added. “The business environment improved dramatically.”

Many businesses selling must-have items did well after the storm.

Keith Koenig, CEO of the City Furniture chain, which is based in Tamarac, said the storm wiped out his company’s location in Cutler Bay. At the time, the business was known as Waterbed City.

“We were pretty devastated by that,” he said. “The insurance company covered that. Our business really boomed because people needed to replace furniture where their homes and apartments were wiped out.”

“It was a disaster, and also an opportunity,” said Koenig, who also serves as a board member of the Atlanta Federal Reserve’s branch in Miami. “We dealt with the hurricane and our business actually boomed for about nine months. It was an artificial temporary boom and then got back to a more normal level of business.”

He, too, counts the strengthened building codes as being “at the top of the list in my mind” as being a major change for the good driven by Andrew.

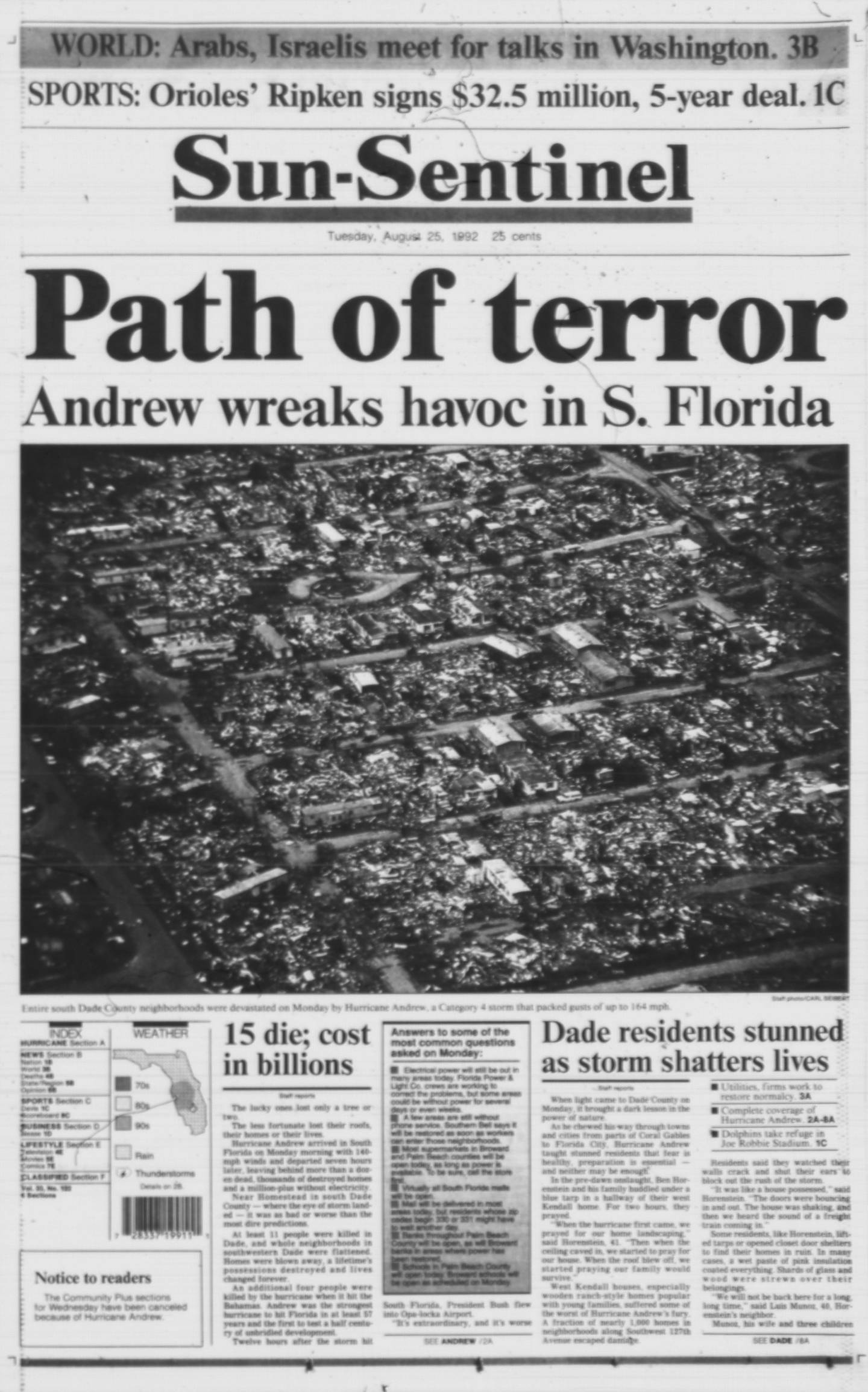

The Aug. 25, 1992, front page of the Sun Sentinel, a day after Hurricane Andrew blasted across South Florida. (South Florida Sun Sentinel)

“Builders were really concerned this would drive up costs,” he said. “But it didn’t slow down demand. Now, any home not built to that level of that resilience is not as valuable.”

Northward ho — instant growth for Broward

The storm dramatically forced shifts in the population. driving nearly 40,000 people out of Miami-Dade permanently, according to the UF report, with many moving to the Broward County cities of Miramar and Pembroke Pines. Both are now among the region’s fastest-growing cities.

“People got their insurance money and the entire population shifted from Dade County to West Broward County almost overnight,” said attorney Keith Poliakoff, managing partner of the Government Law Group in Fort Lauderdale. “I always thought that was amazing.”

Previously, the West Broward area was “nothing but land and cattle,” he added.

Bob Swindell, president and CEO of the Greater Fort Lauderdale Alliance, recalled that a significant amount of residential development already had been underway when the storm hit, effectively providing housing opportunities for Hispanic and Caribbean-area residents who resided in south Miami-Dade and needed to find new places to live.

“Fortunately, there was enough product coming online in Broward,” he said. “We had the first Caribbean-American majority city commission in Broward County and in the country. It changed our politics and the culture and the makeup of our county.”

Villamil said the population movement created “a truly integrated economy,” especially between Miami-Dade and Broward.

“We truly have a megalopolis between Dade and Broward, including Palm Beach County,” he said. “This is likely to accelerate with Brightline and Tri-Rail and the ability to commute between counties.”

Better preparations emerge

For FPL, there were numerous lessons learned about how to respond to such a disaster. It had no idea in 1992 how to beef up the workforce before the storm, how to house those workers, how to feed them, where to stage the work trucks, where to stage the food.

The utility has more than 100 staging sites now, said Manny Miranda, executive vice president for power delivery.

He recalled that after Andrew struck, he received an initial damage report from a co-worker.

“He said, ‘Manny, every single pole is down,’” Miranda recalled. “I said, ‘Maybe it’s where you’re standing.’ He said, ‘No, everything is devastated.’”

Miranda would soon learn that description was accurate. The utility replaced 20,000 poles for 1.4 million customers.

The utility’s storm recovery process is very different now, he said.

Boats damaged by Hurricane Andrew at Black Point Marina in Homestead on Sept. 4, 1992. (Judy Sloan Reich/South Florida Sun Sentinel file)

“We already have pre-determined where material goes, where the tents go, where trucks park, how to fuel trucks. We can house people, we have mobile trailers for sleeping, mobile trailers for cooking,” he said.

The company also learned to have its workers toil alongside city cleanup crews. One thing that happened during Andrew was that municipal crews bulldozed entire areas to get them cleared, destroying electrical equipment in the process.

Miranda said about 45% of FPL’s electrical lines are underground.

“One of the things we know is our main transmission lines, our main circuit lines, what we call main feeder lines, they hold up pretty well during a hurricane,” Miranda said. “The issue for us during Hurricane Irma was overhead lines in people’s backyards.”

Miranda said access and restoration is complicated by trees, swimming pools and sheds. The utility is looking to put all neighborhood lines underground and harden them all to withstand 145 mph winds.

Zoo Miami in South Miami-Dade learned it needs a post-storm plan, including having generators for air conditioning animal housing.

“I think the zoo is much-better prepared in dealing with the aftermath than we were initially,” Magill said. “The sense of having a pre-determined evacuation for animals post-storm, having generators now built and located throughout the park, having our stations properly managed and maintained so we can deal with excess water. I think that experience is going to be invaluable should another storm of that magnitude come through.”

Swindell believes the state now has a better storm preparedness culture.

“People were moving to Florida and a lot of new folks had never been in a hurricane before,” he said. “You’d have a hurricane party at a local bar and go out and buy stuff you would never buy.”

“That mindset really got shaken up. I think people take it much more seriously. We’re building much better.”

Three generations of one family lost their mobile homes at the Dadeland Mobile Home Park in Kendall when Hurricane Andrew hit South Florida. Tamra Giffen comforts daughter Catlin, 3, while grandmother Dorothy Giffen rests on what was left of a neighbor’s home on Aug. 25, 1992. (Jim Virga/South Florida Sun Sentinel file)

The next ‘Big One’

Economists still warn that another storm of Andrew’s magnitude could well create much more damage than in 1992 mainly because of the sheer rise in the region’s population, which is now 6.1 million, up from the 4.1 million people who lived here three decades ago.

The increased density caused by a development boom has created higher real estate values that could easily be deflated by another natural disaster, they warn.

“Where we might be underestimating is the actual cost,” said Sofia Johan, an economist at Florida Atlantic University. “The population has doubled in the last 20 years and the population’s wealth has possibly doubled, if not quadrupled.”

“Whatever damage happens is going to be even more expensive,” Johan added, noting that insurance companies are dropping customers and raising rates.

Florida’s insurance market has spent most of the last two years on life support, battered by financial woes, the South Florida Sun Sentinel recently reported. Heavy losses caused widespread fears — just before the official start of hurricane season on June 1 — that a large number of companies would not be able to meet the state’s minimum financial-strength requirements to protect all of the state’s property owners.

“I get dropped by my insurance companies on a regular basis for whatever reason,” Johan said. “I am thinking about all of those people who cannot afford the 60% to 70% increases in insurance. What would happen to them?”

Hollywood Mayor Josh Levy reminds people that sea level rise is a major concern.

“If a storm hits at King Tide we could be worse off as a region,” he said. “We’re certainly taking steps to raise the seawalls and public shorelines to reduce the likelihood of flooding in a perfect-storm situation. Conditions led by sea level rise make the challenge all the more harder. The bar is set higher by nature itself.”

Staff writer David Lyons can be reached at dvlyons@SunSentinel.com. Staff writer Chris Perkins can be reached at chperkins@sunsentinel.com.

Article Posted on: 30 years after Hurricane Andrew: How resilient is South Florida?

Author: David Lyons and Chris Perkins