Law360 (September 2, 2022, 4:01 PM EDT) — With economic forces and local market trends driving up prices for South Florida commercial real estate, the mutual needs that marked tenant-landlord relationships during the depths of the pandemic have given way to property owners motivated to seek out technicalities and other creative means to oust tenants in favor of higher-paying replacements, attorneys say.

Continued high demand and limited supply has mostly insulated the South Florida market from the slowdowns seen across the country as a result of recent boosts in inflation and interest rates. But tenants and landlords still find themselves entwined in a sort of dance as each tries to find security and advantages in the uncertain environment.

With prices increasing for South Florida commercial real estate, property owners are motivated to find creative ways to oust tenants in favor of higher-paying replacements, attorneys say. (AP Photo/Wilfredo Lee)

“I’m sure there’s some landlords and tenants who are still working together nicely and all that. But for the most part, with inflation going up and the prices going up, I think there’s a lot of self-preservation involved now, and it doesn’t always work as well as it did in the pandemic when everyone was similarly situated,” Jordan Isrow, a commercial litigator with Fort Lauderdale-based Government Law Group PLLC, told Law360. “I don’t think people are similarly situated now.”

The economy has also put some tenants in positions where they are the ones looking for the exit in the face of changing business fortunes, and the strong market pressures have pushed some property owners to decide their best option is to cash out as well.

In some cases, these diverging factors can lead to litigation, but the accompanying time and cost is often a significant deterrent at a moment when both are precious, opening the door for lawyers and other real estate professionals to pursue some creative solutions of their own, they said.

“There’s a whole lot of possible options and scenarios, and what we’ve become really good at is looking at all those options and helping get the best outcome for our clients,” said Nico Romano, who leads the real estate team at Coral Gables boutique Spiritus Law.

The South Florida region covering Miami-Dade, Broward and Palm Beach counties emerged as one of the hottest real estate markets as the nation climbed back from the COVID-19 pandemic. The area’s mix of warm weather allowing for year-round outdoor activities, favorable tax laws and what were at the time more affordable prices, spurred an influx of people, businesses and capital across just about every real estate segment.

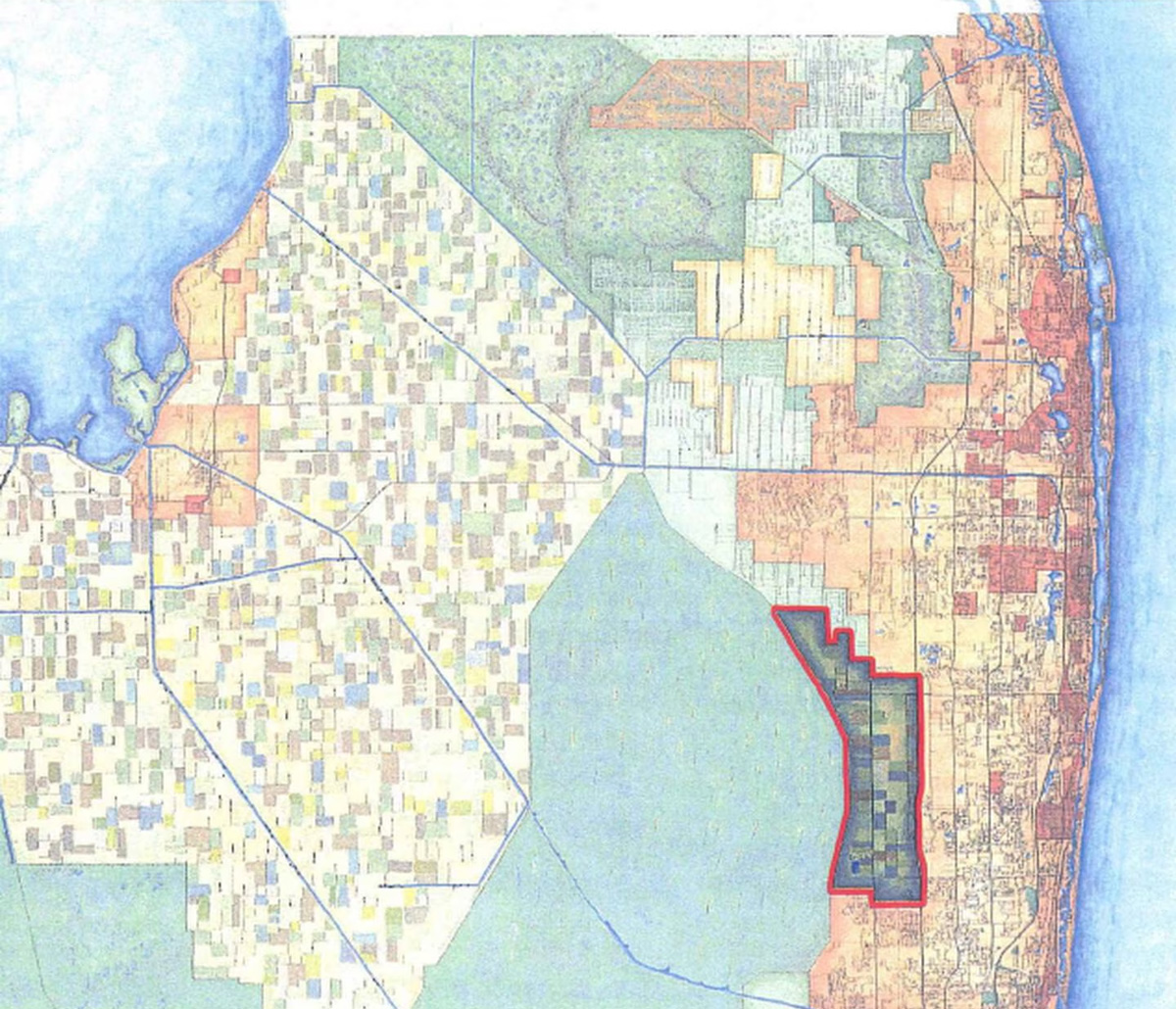

Development has been brisk, but geography has helped keep supply tight, especially in the busiest, most-developed areas in Miami-Dade County, which is sandwiched in an 18-mile-wide strip between the Atlantic Ocean and the protected Everglades.

Nonetheless, the market has stayed strong enough to forge ahead despite the economic headwinds.

“Inflation is never really great … but this upward pressure from inflation, which would normally cool things off, hasn’t really affected South Florida because of all the demand for space,” said Romano, who in addition to his law practice owns some commercial real estate himself.

This high demand, aided by inflation, has sent rents upward. According to second-quarter reports from real estate company Colliers, Miami-Dade County saw retail asking rates reach a record high of $42.10 per square foot, representing a 15% increase since the middle of last year, while office rents jumped 8.7% and industrial rates increased 5.6% amid record low vacancy for that segment.

Palm Beach and Broward counties also set records in retail, after 16.1% and 13.5% year-over-year increases, respectively. Palm Beach County, which is seeing major development in downtown West Palm Beach to accommodate incoming financial firms and other businesses, saw office asking rates vault by 9.1%, while intense demand for industrial space in Broward led to a 22.4% increase for a record $12.18 average rate for triple-net leases.

Erin Byers, a senior managing director at Colliers who specializes in industrial properties, noted that there has been not only an increase in online shopping over the past couple of years, but also a broader shift in consumers wanting just about everything delivered to their homes or available for in-store pickup — and quickly.

“It’s all the companies kind of looking to compete with the 800-pound gorilla Amazon. So it’s those tenants and those tenants offering services to them to create that last-mile or early delivery that continues to fuel the market,” she said, noting that includes food service tenants needing to expand.

But while Byers said she has not seen inflation manage to slow down business in South Florida, she noted that rents have accelerated at a “very high level” over the past few months, resulting in rates soaring by as much as 40% to 60% for some tenants. This trend has affected negotiations over lease renewals, which is typically the only time a landlord has a chance to reset rental rates.

Given the market’s direction, tenants probably want to renew early because finding a new space requires additional time and money, Byers said. But while landlords are generally looking to keep their tenants, in an effort to achieve the highest rent possible, many have been waiting until closer to the expiration date to start talks, rather than the customary six to nine months out.

“Just because the market’s moving so fast, they are looking to see if the market continues to go up and not leave any rental rate on the table,” Byers said. “They also create a leveraging point. If they wait until three months before the lease is expiring, the tenant won’t have time to relocate.”

Having tenants on long-term agreements typically provides a landlord with greater security and enhances property values. However, with today’s dramatic upswing in rates, landlords with long-term tenants now find themselves unable to capitalize on the market.

“When the market is very stable, people look at a property and say, ‘There’s a lease that has 10 years left. That’s very attractive because we have nice predictable income for this property, and the tenant’s going to be there for long term,'” said Louis Archambault, a real estate partner in Miami with Saul Ewing Arnstein & Lehr LLP. “When the market increases very quickly, now they’re saying, ‘Well, I want a building where the leases are all expiring within a year so I can increase them.'”

A tenant in the midst of a long-term lease today likely has a rate that was fair at the time of signing, but is now below market, Isrow of Government Law Group said.

“So a lot of these landlords are getting offers or are getting inquiries from other potential tenants and, of course, they’re all willing to pay a higher dollar amount because that’s what the market provides for now,” Isrow said.

For many of the out-of-state operators entering the region, even the increased rates still seem affordable compared to what they were used to paying in places like the Northeast or California, Romano of Spiritus Law noted.

With replacement tenants on deck and willing to pay more, many landlords are champing at the bit to terminate leases.

Sometimes the solution is as simple as the landlord asking tenants for their price to be bought out of their lease, Romano said, but the challenges of finding a new space or the desirability of the current location may lead a tenant to reject a buyout.

When that happens, landlords often turn to technicalities and other strategies, Isrow said, identifying several potential strategies.

“The first thing I always recommend is that it starts with the lease,” he said. “The lease agreement sets out the road map of what are the possibilities and what are also the risks of trying to go down this road.”

Reviewing monetary grounds is usually the initial step, checking whether the tenant has missed payments on rent, its share of the common building element expenses or taxes, Isrow said.

Then there are nonmonetary obligations, such as failure to obtain or renew tenant’s liability insurance, which is a common requirement. Unauthorized assignment or subletting of the premises is another item to check, with some leases containing restrictive covenants that prohibit particular business uses or storage of certain materials, for example.

Over time, landlords tend to be become more relaxed and long-term tenants may be able to operate more independently, as long as they keep up to date on their rent checks, Isrow said. That was especially true during the pandemic, which required businesses to adapt to unprecedented situations. But in the current environment, landlords are using another common lease provision — the right to entry as landlord — to seek out infractions.

“They want to take a look at the premises and see if it’s in good condition. But by doing that, what they’re really doing now is going in to look to see if there’s anything that the tenant is doing that’s improper or otherwise probably prohibited under the lease to see if they can find the grounds to terminate the lease,” Isrow said.

Another area where Isrow said he has had success helping landlords free up spaces is through technicalities in the lease renewal process itself. Most lease agreements include requirements about how and when to give notice and for the tenant to be in good standing at the time of renewal. In at least one instance, one of Isrow’s clients successfully called out a tenant for not being in good standing at the time it submitted a renewal request.

“Others had been just really nitpicky and technical on the notice provisions,” he added. “You’d be amazed that most people nowadays assume that an email is proper notice, but if an agreement doesn’t expressly provide for that, and it says for some other process, then that’s also been a successful way of doing that.”

Landlords can get even more creative by taking strategic actions to put a tenant in a position where it has trouble satisfying the lease requirements. Many leases include a requirement for tenants to pay for a percentage of common elements, so if a landlord decides to renovate the property’s parking lot, for example, a tenant who is already struggling to cope with increased business costs and facing higher interest rates may not be able to come up with the needed money. Additionally, the work may temporarily remove access to facilities the business relies upon, making it harder for the company to continue operating in that space.

“Some of those things can be used tactically because it’s allowed for in the lease,” Isrow said. “It puts the tenant in a tough spot. They’ve agreed that the landlord can do the work. Of course, the landlord has to be careful not to do anything intentional to make it more problematic, but sometimes just by virtue of the work itself, it can interfere with an operation. And a landlord who has the right reason to do the work can usually use that to their advantage.”

From the tenant’s perspective, businesses that are looking to get out of leases, for example for retail spaces or offices that are now bigger than they need, are likely to be able to successfully negotiate a buyout with their landlords, Romano said. Some may also look into the possibility of subletting space, if allowed under the lease.

There are circumstances, however, that can lead to litigation, the most likely being where a landlord is blatantly trying to manufacture a technicality to terminate the lease and where it would be particularly burdensome or detrimental to the tenant to have to move to another location, Romano said.

“You have to find out what ultimately is the desire of your client,” he said. “If this is the only possible place, OK, you dig in your heels.”

Many leases contain attorney fees provisions, which require the losing side to cover the prevailing party’s legal costs. That gives a tenant that feels it has a very strong case greater opportunity to take a landlord to court, but also poses an additional financial risk, the attorneys said.

“There’s a lot more risk in terms of not just having to pay your own attorney, but having to double that to pay the other side,” Isrow said. “So I think the primary rule is avoid litigation, if at all possible, and it’s kind of the last resort.”

Creative steps can also help resolve a sticky situation for the various sides.

“Everyone wants something. It’s just a matter of discovering what that is and making sure it works for everybody,” Romano said. “Whether it be one way or another, it’s — I don’t want to say fun — but we have a knack for coming up with things that may be out of the box.”

Drawing from his own experience as a landlord, Romano recounted a situation in which a tenant with a substantial lease was seeking either to receive a buyout or pay some minimal amount to exit a lease. He was able to find a developer that was interested in the property and ended up selling it for a price he wanted, while the tenant did not have to pay a substantial amount for the remainder of the lease as part of the agreement.

“So I was able to save everybody money, aggravation and time by figuring out how to make it work for everybody,” he said.

Romano’s experience is one example of the current market conditions contributing to a property owner deciding to sell. The economy has also resulted in some landlords finding themselves in situations where they almost have no choice but to sell, the attorneys said.

“Owners that have properties where their debt service is very high, or they are in a situation with a property that may require a lot of improvements, and they don’t have the equity or the cash flow to be able to make those improvements, they’re most likely going to have to sell just because of the market conditions,” Saul Ewing’s Archambault said. “Unless they’re able to fix those deficiencies, they may not have a choice.”

Looking ahead, the experts said while there is the possibility that conditions will worsen into a recession, they are cautiously optimistic that inflation will level out, and the market will adjust and move forward at the new rates and price points.

“There’s a lot of worry related to uncertainty, but it’s vastly different than what we had at the end of the 2000s, where financial institutions were in a recession and there was instability in the financial institutions,” Archambault said. “It’s just interest rates that are rising. … The banks are fine financially. They’re just charging more in interest for the loans.”

Colliers’ Byers said she thinks the South Florida market has some significant factors that will keep driving it forward, but there are limits. As rates keep rising, businesses looking to expand may have to rethink those plans, and some tenants may eventually get squeezed out to second-tier markets, especially in the industrial segment where space is at such a premium.

“Rates and valuations of buildings can go up for only so long before they have to level, just from an ability to withstand those increases,” she said. “I feel comfortable and confident in our market. However, I do realize that not everyone can afford to double their line item of their expenses just with rent alone.”

–Editing by Jill Coffey.

Article Link: CRE Landlords, Tenants Fight For Upper Hand In S. Florida

Auther: Nathan Hale