The multi-building development highlights what other builders often confront when working the now-hot Miami River waterfront

In the middle of Miami’s glitzy Brickell neighborhood, archeologists have uncovered thousands of artifacts and human remains at a riverside site. Those findings, some experts say, are the clearest indication yet of life in what’s now Miami dating back 7,000 years — older than the first cities in Mesopotamia or the construction of the Giza Pyramids in ancient Egypt.

“It’s a phenomenal site. It would completely change everything we know about archaeology in Miami and South Florida,” said Sara Ayers-Rigsby, a professor at Florida Atlantic University and the director of the Florida Public Archaeology Network.

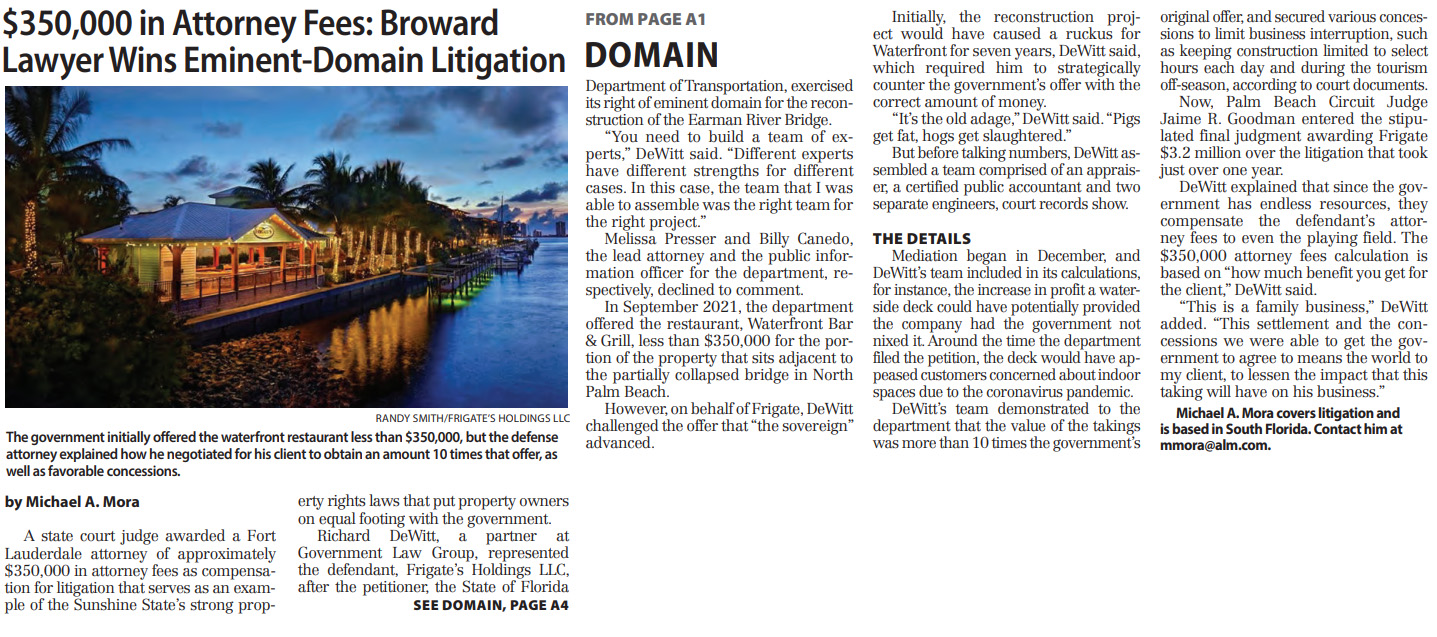

But not everyone is so thrilled. Miami advertises itself as a developer’s paradise, championing the next big project. The property’s owner, Related Group, Miami’s largest condo developer, is planning to build a three-tower development on the site at 77 SE Fifth Street and 444 Brickell Avenue, considered one of the city’s most sought-after locations.

As preservationists and some residents press opposition, the crown jewels of Related’s development, a Baccarat-branded condo tower and a luxury hotel, hang in the balance. City officials, after months of silence, have taken the first step in possibly designating parts of the parcel as a protected archaeological landmark. The proceedings have already delayed construction and could potentially torpedo the development.

Related bought the 4-acre site, which faces the Miami River, for $104 million in 2013 just as Brickell was being recast from a sleepy residential neighborhood into a financial center, home to glistening skyscrapers. The developer left the two existing 1970s-era buildings untouched, until Miami’s real estate market took off during the pandemic.

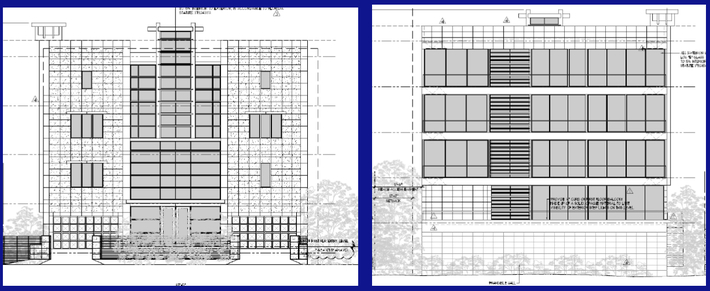

An influx of wealthy Northerners seeking low taxes, year-round sunshine and refuge from stringent COVID restrictions, sent prices of Miami condos skyrocketing. In early 2021, Related unveiled plans to build three buildings on the prime site: a 44-story rental, an 82-story hotel and condo, and a 75-story condo. The third tower would be branded by Baccarat, the 259-year-old French luxury crystal maker. Jorge Pérez, Related’s chairman and CEO, hyped the Baccarat building as his firm’s “most luxurious product” in its 45-year history.

Centuries ago, the section of the Miami River, which opens to Biscayne Bay, was home to the Tequesta indigenous tribe and village, considered South Florida’s largest settlement prior to the arrival of Europeans. In 1513, Spanish explorer Juan Ponce de Leon encountered the Tequesta by the mouth of the Miami River. Previous excavations have uncovered artifacts dating back 2,000 years.

“Anybody who buys anything along the river, especially at the mouth of the river, knows what they’re getting into,” said Traci Ardren, an anthropologist and archaeologist at the University of Miami who specializes in New World prehistoric cultures. “It’s one of those buyer beware situations.”

Since the 1980s, city regulations have required developers to check parcels along parts of the river and bay for archeological remains and artifacts before breaking ground. Related hired veteran archeologist Richard Carr to conduct a search. In April 2021, Carr sent the city a “notice of discovery.” As required by law, a full excavation ensued, which Related says has cost over $20 million.

The archeologists uncovered at least two gravesites with skeletal fragments, possibly part of a ceremonial burial, as well as postholes, which could be the marks of a prehistoric structure. Overall, the diggers found 16,610 pottery shards and 340 bones. Perhaps most notable were the dozens of projectile points that appear to date back to the Archaic period, which in the Americas stretched approximately between 8,000 to 500 BCE.

While Carr believes the Tequestas found the artifacts centuries after their creation in northern Florida, other experts disagree. Those discoveries have the potential to push back the timeline of when Native Americans inhabited what today is considered Miami by thousands of years, according to William Pestle, the chairman of the University of Miami’s anthropology department.

“The mouth of the Miami River, which is obviously today prime real estate, was also prime real estate a 1,000 years ago, 2,000 years ago,” Pestle said. “And now maybe more: 5,000, 6,000, 7,000 years ago.”

Carr himself believes the parcel is worthy of preservation. The site “is eligible for listing in the National Register of Historic Places … because the site provides important data documenting prehistoric culture, subsistence, and settlement patterns in South Florida, and specifically the Tequesta culture on the Miami River,” Carr wrote in the public reports, adding his recommendation that “intact portions of the site be avoided if feasible”.

Yet, as 2023 dawned, it looked like Related was getting ready to start construction — with the apparent blessing of the city. The developer took out a $164 million construction loan to begin work on the rental tower, property records from December show. The company was also close to securing a second mortgage for the Baccarat development, a Related spokesperson told Commercial Observer in January, even though the excavation had yet to end. That excavation remains active today on part of the site, while construction has started on another part.

The loans were evidence that Related had secured permits from the city for one tower and was close to securing permits for another. City officials had yet to publicly comment on how it would handle the archaeological artifacts, a sign that it was prioritizing the development. (City officials did not respond to Commercial Observer’s multiple requests for comment.)

Frustrated by the city’s silence, independent local archeologists began showing up to the public meetings of Miami’s Historic & Environmental Preservation Board, the regulatory committee charged with overseeing the dig. They demanded that the board preserve the site. Just a day after the Miami Herald published a scathing article, the board unanimously voted in February to begin studying whether the site, where the Baccarat development was set to rise, merited legal protection — reversing its previous pro-development stance. The move seems to have stalled Related’s construction. The much-expected second construction loan has yet to appear in property records.

Archaeology has already blocked other Miami developments.

In 1998, developer Michael Baumann bought a parcel across the street from Related’s contested site to build a luxury condo. Before construction began, archeologists discovered a circle measuring 38 feet and containing 24 holes — indicative of a religious structure — as well as shell, stone, bone and pottery artifacts from the Glades culture and the Tequesta civilization. Public outcry followed. Florida’s state government bought back the parcel for $26 million and preserved it. In 2009, the site, which is now called the Miami Circle, was designated a National Historic Landmark and today houses a dog park.

Most times, though, ambitious Miami projects move forward. Across the river in Downtown Miami, MDM Development Group planned a multi-tower, $1 billion luxury development meant to revitalize Miami’s urban core. On one site, archeologists unearthed a portion of the Tequesta tribal village, including a cemetery, dating back 2,000 years, as well as the foundation of the Royal Palm Hotel, which oil magnate Henry Flagler built in the 19th century. The excavation took about a decade, but MDM eventually completed a 34-story, mixed-use building called Met Square in 2018.

Related is ready to fight. It has told the condo buyers of the Baccarat development, which is nearly sold out, that the project is moving forward. We “have property rights. We own this parcel and have worked with the city and the state governments to establish those development rights,” Jorge Pérez wrote in a Miami Herald op-ed last month. Although he vowed to preserve the artifacts for research and display them in a “major” exhibition, the developer accused preservationists of exaggerating the importance of the findings. The artifacts, while “important,” are “not as old as the pyramids,” Pérez wrote. (A spokesperson for Related declined a request for an interview.)

The law is on Related’s side, according to Keith Poliakoff, a founding partner of Government Law Group law firm, which has represented property owners and local governments in disputes involving archaeological discoveries. The Preservation Board is unlikely to prevent Related from building. If the project is blocked, a governmental entity would need to buy the land from the developer. The price tag would likely be too high. Perhaps even more costly would be the long-term negative impact on Miam’s pro-business and pro-development bent, Poliakoff said.

At the Preservation Board’s latest public meeting April 4, board members tried to broker a compromise. At Related’s request, they withdrew plans to move forward with designating a portion of the site a historical landmark. In return, the developer must work with archeologists and Native American tribes to come up with a “preservation action plan” six months after the ongoing excavation is completed. The board would still need to approve the proposal, which is likely to include exhibition space at the development and the addition of a plaque explaining the site’s historical significance. As stipulated by Florida law, human remains will be removed and reburied under the guidance of Florida tribes, including the Seminoles, who declined Commercial Observer’s request for comment.

The arrangement allows Related to move forward with the Baccarat development — for now. A lawyer representing the developer said delays caused by the designation process would have cost Related “hundreds of millions of dollars in damages” with financial partners, investors, lenders and condo buyers. The compromise also avoids, as one board member cautioned, “protracted litigation.” After the April 4 meeting, Related issued a statement saying it was “pleased with the board’s decision.”

The ordeal appears to have spooked other developers. Fortune International Group’s Edgardo Defortuna, 13th Floor Investments’ Arnaud Karsenti, and Integra Investments’ Nelson Stabile, who all have luxury condo developments in the works in and around Brickell’s waterfront, spoke in opposition of historical designation. Defortuna and Stabile sat through the entire six-hour meeting.

As pressure mounts, further delays, and even cancellation, are not out of the question. The meeting drew such a large crowd that a tent was installed outside of Miami City Hall to accommodate those without seats. During the meeting, both opponents and proponents spoke for over an hour and a half.

Another battle looms for the other half of Related’s site — which archeologists have yet to excavate. It houses a 13-story office building. Related wants to eventually demolish it to make space for the luxury hotel. Because it’s located between the excavated site and the Miami Circle, the land is likely to hold a trove of historically significant objects. Ideally, archaeologists want the site to be left untouched, viewing it as the last opportunity to preserve a probable archeological treasure trove since much of Brickell and Downtown Miami has already been developed. They’d even prefer no excavation take place as excavation methods improve over time, reducing the risk of ruining uncovered artifacts.

The Preservation Board unanimously voted to initiate the landmark designation process for that portion of the parcel. By starting the procedure early, board members want to reach an agreement with Related before it puts in place financial commitments in hopes of preventing another frantic fight. They’re expected to make a final decision in July after city staffers present their recommendations. “We will work with the city hand in hand on the designation of the site. Our efforts will continue to be transparent and inclusive,” Related said in a statement.

But some fear the board is setting a bad example. “When we think of Miami, we don’t think of people and preserving their history. We think about the new and about moving forward,” said Helena, a Miami resident who spoke at the April 4 hearing and did not give her last name. If this site doesn’t meet the standard for preservation, “then what does? Do we need to find Noah’s Ark?”

Julia Echikson can be reached at jechikson@commercialobserver.com.

Article Link: Related Group Digs In on Brickell Project That Unearthed Ancient Artifacts

Author: JULIA ECHIKSON