Live Local Act to provide millions in affordable housing across Florida

Governor Ron DeSantis signed the Live Local Act yesterday, promising millions in affordable housing funds and preempting local restrictions.

Housing in Florida is a well-known and difficult issue for residents to navigate. As the state’s population continues to grow, fuelled by deep-pocket individuals from California, New York, Illinois and other high-tax states, housing prices and rental rates alike have soared over the last few years. Consequently, affordable housing has become a rallying cry for local officials, community leaders, and everyday Floridians. Now, the Live Local Act promises relief – but developers will need to make full use of what the bill offers for it to work.

“When I moved here to Naples almost 43 years ago, the community was talking about the lack of housing for our workers,” said Senate President Kathleen Passidomo, who the Governor credits with shepherding the bill through the legislature. “It was a problem then and remains a persistent problem in many areas of our state – that changes today!”

The bill, formally known as SB 102, provides $711 million in funding for affordable housing projects, low-interest loans, preempts municipalities ability to regulate height and density restrictions, and prevents the implementation of rent controls. According to attorney Keith Poliakoff of the Fort Lauderdale-based Government Law Group, the bill “takes a lot of the handcuffs off” of affordable housing development, reported TheRealDeal.

The bill provides $259 million for the Florida State Apartment Incentive Loan (SAIL) program, which provides low interest loans for workforce housing projects. SHIP – the State Housing Initiative Program, also receives $252 million to incentivize local government partnerships with developers to preserve or build new housing. Both programs are administered by the Florida Housing and Finance Corporation (FHFC).

The FHFC will also receive a one-time $100 million for the creation of a competitive loan program for developers looking to cover inflation-related costs in FHFC approved multifamily projects that have yet to break ground. The funding will likely provide relief as financing certain projects becomes more of an issue as rates continue to rise and lenders pull back. As Roy Faith, senior vice president of investment and development group The Faith Group, explained in an earlier interview with Invest: Miami. “You have to have great relationships with banks and financial institutions as well as with your partners. That is challenging in today’s market. There are a lot of projects that have been delayed right now because of what we are seeing in the market. In the next six months to a year, we will see how the market changes and that will impact many of the deals moving forward,” Faith said.

The bill also codifies the popular Hometown Heroes Housing program, a homeownership assistance program begun last year that allows law enforcement officers, firefighters, educators, healthcare professionals, childcare employees and active military personnel or veterans to receive first time income-qualified down payment and closing cost assistance.

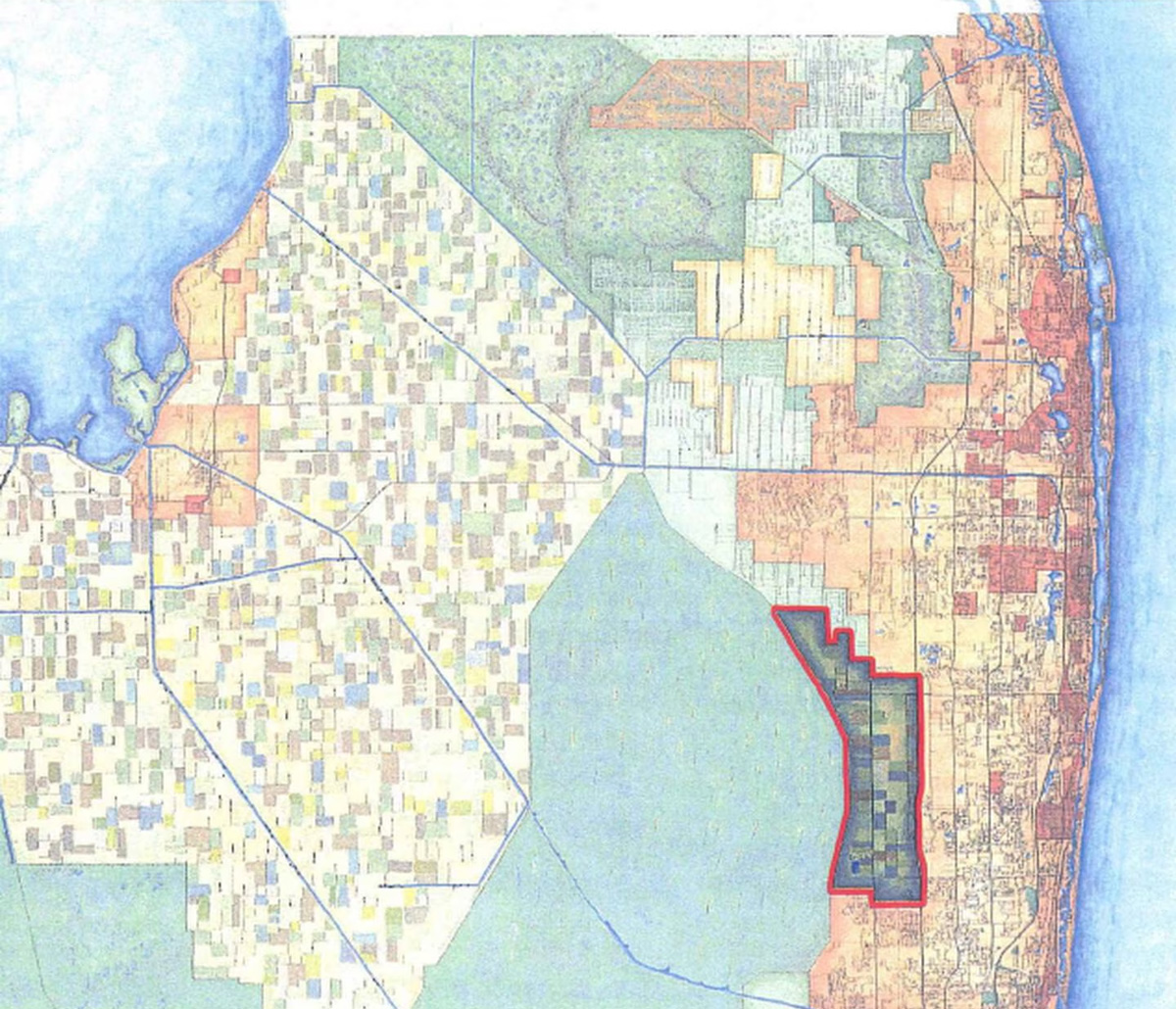

Zoning concerns are also addressed in the bill. What was once a mundane part of the development cycle has become increasingly contentious across the state. Municipalities have been increasingly caught in the middle, attempting to relieve housing costs by upzoning for developers while simultaneously limiting changes to specific, often transit-oriented corridors to placate residents. In some cases, upset residents who oppose higher density and new development have worked and succeeded in making the process as arduous as possible in the hopes of project cancellations.

Under the new law, the decision has been removed from local officials’ hands. For the next 30 years, local governments are now required to allow multifamily or mixed-use residential projects that set aside at least 40% of the residential component for affordable housing. In projects where 65% of the square footage is residential, a county cannot restrict the height of the project to anything less than what’s currently allowed within one mile of the plan. The law also requires local officials to look at reducing parking requirements for projects within a half mile of major transit stops.

While there may be some questions, and no doubt some upset citizens, to emerge over the coming weeks and months as developers, attorneys, and local officials relay the information to their respective stakeholders and adjust to the new reality, the state seems poised to embark on what could be another building boom, even as national economic uncertainty begins to slow demand in some Florida markets.

“Together, we are shutting down affordable housing stereotypes and creating attainable housing options needed by the majority of our workforce, the backbone of Florida’s economy… As our state continues to grow, our Live Local Act will make sure Floridians can live close to good jobs, schools, hospitals, and other critical centers of our communities that fit comfortably in their household budgets, no matter the stage of life or income,” Passidomo said.

The full text of the bill is available here

For more information, visit:

Article Link: Live Local Act to provide millions in affordable housing across Florida

Author: Joshua Andino