Florida’s Live Local Act Has People Picking Sides

Developers love the affordable housing law — the first of its kind in the nation — for the same reasons that local officials are starting to loathe it.

Even its critics think Florida’s Live Local Act is working. In fact, they think it’s working too well.

Local politicians are concerned that the new state law encouraging development of rent-restricted workforce housing is encroaching on their authority as it prohibits public hearings on such projects and overrides land development rules in cities and counties.

In response, state legislators feeling the pushback are proposing bills to amend — and perhaps undermine — the 6-month-old law.

“The Florida Legislature has done a complete 180 based on local government political pressure,” said real estate attorney Keith Poliakoff, a partner at Government Law Group in Fort Lauderdale. The Live Local Act was a bipartisan measure that had tremendous support during the 2023 legislative session. It passed on votes of 103-6 in the Florida House and 40-0 in the Florida Senate.

“Senators and House members on both sides of the aisle came together to adopt this plan,” said Poliakoff. “What they did not factor was that the bill would have tremendous pushback, and looked at with venom by cities and counties throughout the state.”

The law has stirred a herd of developers to qualify for its benefits by proposing mixed-income multifamily developments on sites zoned for commercial use.

“Every single client I have with a [property development] project has asked for an analysis as a Live Local and a regular project,” said Miami-based attorney Anthony De Yurre, a partner in the land development and government relations group at law firm Bilzin Sumberg. “Why? They are just trying to get projects built in an impossible environment to get projects built because of construction costs, financing costs and insurance costs.”

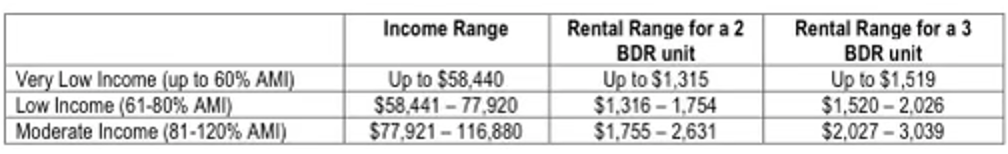

To qualify as a Live Local rental apartment development, at least 40 percent of the units must have below-market rents, and they must be reserved for tenants who earn less than 120 percent of area median income. Area median income ranges from $64,215 a year in Miami-Dade County to $70,331 a year in Broward County and $76,066 a year in Palm Beach County, according to U.S. Census data. The Live Local Act defines affordable rents as those below 30 percent of the tenant’s income.

City and county leaders in Florida have criticized the Live Local Act because it can subordinate the application of local land development rules to the state law, overriding local zoning and limits on building height and density.

“Normally, I would tell you that you can’t build an apartment complex in a commercial plaza. That’s where the public is supposed to go. But what Live Local says is, yes, you can do that,” said Eric Power, the director of planning and development services in Deerfield Beach, during his presentation on the Live Local Act at a recent meeting of the city commission. “Live Local also takes away our ability to regulate certain things related to height and density.”

One of the first controversies stemming from the new state law erupted when Montreal-based Jesta Group proposed redeveloping the five-story Clevelander hotel and bar in Miami Beach as an 18-story residential building, where 40 percent of the units would have below-market rents and the unrestricted units would be sold as condos. The former mayor of Miami Beach denounced the proposal to redevelop the iconic Clevelander at 1020 Ocean Drive as a threat to historic Art Deco buildings throughout the city.

“I hope my successor and our next commission build upon my antipathy for your very horrible idea,” Dan Gelber wrote in a letter of protest to Jesta Group just before his six-year tenure as mayor ended in November, due to term limits. “Ocean Drive is the postcard of our Miami Beach, and your idea would effectively destroy it.”

Florida Gov. Ron DeSantis cited the state’s brisk population growth and its upward pressure on the cost of housing at a ceremonial event last March when he signed the 106-page Live Local Act into law. “We’ve got to make sure our infrastructure and our housing supply are able to sustain this growth,” DeSantis said. “There are some creative things in this legislation which I think will make a big difference.”

DeSantis highlighted $711 million of additional funding for housing-related programs and various tax breaks under the Live Local Act, which took effect July 1. The governor left unsaid the Live Local Act’s power to usurp local control of land development in the name of affordable workforce housing. The new state law also prohibits commissions and boards in cities and counties from holding public hearings on Live Local projects or voting on such projects. A development that complies with Live Local requires only administrative approval by municipal staff.

“The problem with the state legislature trying to impose zoning rules on individual cities is that zoning is not a one-size-fits-all proposition,” said Fort Lauderdale Mayor Dean Trantalis. “For people in Tallahassee to tell people in Fort Lauderdale they should realign their zoning to accommodate affordable housing shows a naivete on their part, in thinking that they can dictate something a thousand miles away as to how these cities operate. It doesn’t work that way.”

Resistance from local governments has led to moratoriums on processing Live Local development plans in Doral and Florida City, two Miami-Dade County municipalities. Other jurisdictions are addressing the new state law one project at a time. For example, the Pembroke Pines City Commission voted 3-2 in November to approve a 50-unit townhouse development by Miami-based Lennar on a 6.7-acre site, and one motive was to preclude the possibility of a Live Local project there. “We would have no control over any of that happening,” said Iris Siple, vice mayor of Pembroke Pines. “Someone could just come and put what they want there.”

The proposed revisions to the Live Local Act that are moving through the current session of the Florida Legislature would restrict which projects would be eligible for Live Local designations, as well as their size relative to nearby buildings. One such revision would restrict the maximum height of a building to those in a quarter-mile perimeter, while another would prohibit developers from pursuing Live Local developments in industrial zones. On the other hand, some modifications would affirm that a Live Local project can be as dense as the densest development in a local jurisdiction, and that Live Local projects near mass transit stops could have fewer than the required number of parking spaces.

Other local governments are dragging their feet as they process applications for development plans based on Live Local, Poliakoff said. “There is not a governmental entity out there that is not slow-playing the applications in hopes the new law [revising the Live Local Act] will take effect, so they can deny the plans they have sitting on their desk.”

Some of his clients, however, are worried about possible changes to the law. “My clients are incredibly upset,” Poliakoff said. “I have five Live Local projects that are pending at municipalities, three of which will be destroyed as a result of the language proposed, if the new law passes.”

Perhaps the hottest issue is the maximum height of projects based on the Live Local Act. The law limits the height of a qualified development with affordable housing units to the height of the tallest building within one mile of the development site. But new legislation would shrink that perimeter from within a mile of the development site to within a quarter-mile.

The quarter-mile perimeter to determine maximum building height is one of several proposed revisions to the Live Local Act in bills that were introduced in the current session of the Florida Legislature. Another proposal would prohibit developers from pursuing Live Local developments with rent-restricted residential units in industrial zones.

“My hope is that there will be a legislative compromise,” said Poliakoff. “My hope is that they will allow industrial back into the mix, and that they will grandfather in any project that applied under the existing law.”

But certain changes to the Live Local Act could be a deal breaker for some developers who plan to take advantage of the state law.

For example, Brooklyn-based Condra Property Group wants to use the Live Local Act to replace a cluster of low-rise motels near the beach in Hollywood with a 282-unit, mixed-income apartment building that would be 18 stories — the same height as the Margaritaville Hollywood Beach Resort, which is within one mile of the site. But if the area that determines maximum building height shrinks to within a quarter-mile, Condra Property Group would likely be limited to the site’s current maximum of five stories.

If the proposed quarter-mile perimeter becomes law, Condra will cancel its plan to build the apartment building with 282 units, 114 of them rent-restricted affordable units, and will instead revive an older plan for a hotel project, said Allen Konstam, managing principal of Condra Property Group.

“We would scrap the Live Local plans. We would go back to developing a hotel,” Konstam said. “We’ve spent over a million dollars to redo the plans [under the Live Local Act] and resubmit them to the city. But we would scrap our plan for affordable housing if we had to develop a five-story residential building.”

Konstam and his partners, Mark Drachman and Ira Chaimovitz, are hardly alone. The Live Local Act also has induced other developers to venture into apartment developments with rent-restricted units, largely because market-rate units can comprise 60 percent of the total residential units on a site where it would be prohibited by a municipal code. Tax benefits in the law provide incentives as well, including exemption from property tax on rent-restricted apartments.

But as a catalyst for development, tax incentives appear to pale in comparison to the power to put residential developments in non-residential zones of cities and counties.

“The reality is people are planning attainable housing for two reasons,” Poliakoff said. “Sixty percent of it doesn’t need to be attainable, and they can maximize density and height in an area that otherwise would have prohibited it.”

The Live Local Act also can apply to planned residential developments that are under construction as well as existing properties that have undergone a major renovation.

For example, the law provides a property tax exemption on affordable housing units that led the developer of Laguna Gardens, a complex in Miami Gardens, to take the exemption on all 341 units in the garden-style apartment development now under construction on 14 acres next to Hard Rock Stadium. The developer, Miami-based Cymbal DLT, broke ground about a year ago, before the Live Local Act was enacted, and expects tenants to start moving in within 60 days. Asi Cymbal, who leads Cymbal DLT, said the below-market monthly rents will start at $2,000 for one-

bedrooms and $3,000 for two-bedrooms.

The Live Local Act can exempt rent-restricted units in a newly constructed (or substantially rehabilitated) residential development from property tax if the development has at least 70 rent-restricted units reserved for tenants who earn below 120 percent of area median income.

“We made a financial decision that by lowering the rents by 10 to 20 percent off what we could have charged, we’re actually making more money due to the tax savings Live Local provides,” Cymbal said. “The city has no involvement with this. If we had asked for more density under Live Local, that would have overlapped city guidelines, and perhaps they would have a say on it, but Live Local dominates and controls. We didn’t have to do that.”

Like Cymbal, Matthew Whitman Lazenby hadn’t planned to become an affordable housing developer until Live Local encouraged him to add a multifamily component to his family’s landmark retail property, Bal Harbour Shops. The upscale open-air shopping mall, anchored by Neiman Marcus and Saks Fifth Avenue, is in the village of Bal Harbour, an affluent suburb of Miami Beach.

“Without the Live Local Act, we wouldn’t be in the multifamily development business,” said Lazenby, whose family has been in the real estate business for four generations. “That wasn’t something we were contemplating seriously.”

Now he plans to leverage the state law to develop 600 residential units, including 240 affordable housing units with below-

market rents, on the periphery of Bal Harbour Shops. The mall is part of an 18-acre property along Collins Avenue, north of Miami Beach. Height doesn’t appear to be an issue, Lazenby said, because the planned residential development at Bal Harbour Shops would be 275 feet tall, shorter than a 320-foot hotel across the street from the shopping center. Lazenby said he hasn’t decided whether to sell the 360 unrestricted apartments as condos or rent them at market rates. Either way, he said, “we’re using the market-rate housing that we otherwise wouldn’t have been able to build to subsidize the cost of the affordable housing.”

It remains to be seen whether revising the Live Local Act or leaving it essentially unchanged will put Florida closer to finding a fix for unaffordable housing. State Sen. Alexis Calatayud and Rep. Vicki L. Lopez introduced identical bills on Jan. 9 in the Florida Senate and House, respectively. Senate Bill 328 has advanced from the Florida Senate’s Committee on Community Affairs to its Committee on Fiscal Policy. House Bill 1239 is now under review by the Florida House’s State Affairs Committee.

Senate Bill 328 and House Bill 1239 propose revisions to the law that include prohibiting Live Local developments on industrial sites and shrinking the area that determines the maximum height of a Live Local development to within a quarter-mile..

More expansive is a pending proposal to loosen parking requirements for Live Local projects near mass transit stops. The parking proposal, originally introduced as Senate Bill 386, is now an amendment to Calatayud’s SB 328, De Yurre said.

“That was an important addition because people need housing. They don’t need parking,” he said. “Local parking requirements are not driven by market demand. They are driven by requirements that have been on the books since before the advent of remote work, Uber, mass transportation and the like.”

De Yurre said the Live Local Act, as is, has worked well because it has encouraged developers to start residential projects they otherwise wouldn’t have started.

“That’s the bottom line here. I have a bunch of [clients with] projects that were shelved. The clients have dusted them off, and we’re resubmitting them as Live Local projects,” he said. “This is the only way we can continue to move the state forward. Our Achilles’ heel is going to be this affordability crisis.”

Article Link: Florida’s Live Local Act Has People Picking Sides

Author: MIKE SEEMUTH