Law360 (December 21, 2023, 5:58 PM EST) — As the year closes, Law360 Real Estate Authority checked in with attorneys, developers, brokers and other professionals for their views on what 2023 meant for the South Florida market and what they are anticipating for 2024.

The region was not spared economic headwinds that swept the nation, but nevertheless, the year proved to be one of perseverance that showed the inflow of people and businesses that took off during the COVID-19 pandemic will have a lasting effect, experts said. The potential for lower interest rates and more economic consistency in 2024 also brings hope for increased development and transactional activity, but how the area handles more growth will be worth watching.

The following comments have been lightly edited for length and clarity.

As you look back on 2023, what events in South Florida real estate do you think were most significant or provided important indications about where this market stands and where it’s headed?

David Martin

One thing we learned in 2023 is that the South Florida market is resilient. Although it was a tough year in terms of uncertainty and increased interest rates, we continued to see great activity and momentum in our market compared to other states across the nation. With the Federal Reserve announcing no additional interest rate hikes in 2024, South Florida will continue to see a flood of new deal flow and activity.

– David Martin, CEO of Terra, whose current development projects include Five Park Miami Beach, The Well Bay Harbor Islands and Villa Miami

Gary Saul

South Florida has always been a great place to live and to work, but we started to notice people caught onto it a little bit. From a real estate standpoint, obviously, that was great. You’ve got pockets of the country that are very, very concerned about office occupancy. Not the case down here. We’ve got a shortage. A new building being developed, 830 Brickell, has some of the highest absorption, highest prices per square foot of any building in the country. … Miami, historically, for way too long was a tourist-only destination. That’s just not the case anymore. You can tell by the types of entities that are coming down here that the growth is real and it’s significant.

– Gary Saul, co-chair of the Miami real estate practice at Greenberg Traurig LLP

Neil Schiller

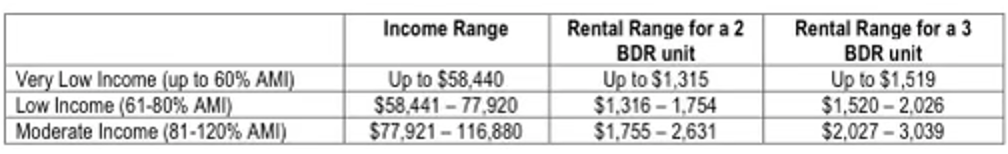

An important event was the passage of Senate Bill 102, the Live Local Act, which aimed to kickstart development of workforce and affordable housing. … The act has succeeded in making traditional developers consider more affordable [and] workforce projects, but with financing concerns and a lack of consistent local adoption, the housing hasn’t yet come to fruition.

– Neil Schiller, partner with Government Law Group in Fort Lauderdale

Mike Pappas

2023 continued to accelerate the movement of ultra-high-net-worth people to South Florida, not only for second homes, but to live and bring their families and businesses — i.e., Amazon’s Jeff Bezos and Citadel’s Ken Griffin. The predictions of Miami being the Wall Street of the South have now been confirmed, and all of those ancillary businesses that served those financial firms are also moving here and leasing space. It’s now personal, family and business.

If looking back at 2023 negatively, it was a surprise to see mortgage loans hit 8% in September and October. That hurt the affordability factor, combined with the insurance escalations in Florida. The good news is we’re seeing that drop precipitously now. The uncertainty of inflation and wars in the Middle East and Europe exaggerated the mortgage rate to a higher spread than normal between the Treasury rate and interest rates. I’m very bullish on the news I’m hearing about mortgage rates in 2024.

– Mike Pappas, CEO of The Keyes Co., Florida’s largest independent brokerage

Rafael Aregger

During a year when most other national real estate markets stood still or were in crisis mode, South Florida kept pushing forward and saw several announcements of large-scale projects. It is especially encouraging to see large-scale developers —e.g., Swire & Related Cos. — announcing substantial new office development, which is unthinkable in most other parts of the U.S. It demonstrates the strength of the underlying local economy in South Florida, which benefits the performance of all types of real estate.

– Rafael Aregger, head of U.S. investments with Switzerland-based Empira Group, which plans to develop two multifamily projects in Miami’s Brickell area

Daniel Diaz Leyva

In 2023, creativity has been crucial to structuring and closing deals amidst a tightening credit market increasingly threatening to derail transactions. It required creative solutions beyond the norm. For instance, we focused on sellers’ financing strategies to compensate for the lack of traditional lending.

– Daniel “Danny” Diaz Leyva, chair of the Florida real estate practice at Day Pitney

Liam Krahe

Over the course of 2023, lenders have tightened their underwriting requirements and pulled back on offering higher leverage due to rising interest rates, regulatory pressures and a higher perception of risk. Accordingly, several developers added alternative sources of financing to their capital stacks for projects in South Florida. We saw preferred equity investments receive the most attention. Additionally, we are seeing new players enter into the preferred equity space.

– Liam Krahe, managing attorney at Cohen Property Law Group PLLC in Miami

Calixto (Cali) Garcia-

Velez

South Florida has benefited from the latest migration trends, reaffirming the region’s position as a business hub both nationally and internationally, with significant capital coming from Europe, Latin America and northern parts of the U.S.

– Calixto (Cali) Garcia-Velez, president & CEO of Banesco USA

Ryan Shear

2023 was a strong year for luxury condo development specifically. Several highly creative developments launched sales or began construction, many ushering in new ways to complement or transform surrounding communities with exciting new concepts of luxury living. We saw a slew of high-priced penthouse listings hit the market and an increased wave of investment from international buyers.

– Ryan Shear, managing partner at PMG, whose Miami development projects include E11even Hotel and Residences and The Elser Hotel & Residences

Nitin Motwani

While rents and costs remained higher than expected throughout the year, I think insurance was the biggest lesson — it’s important to be well capitalized and disciplined because the fundamentals are still incredible for those that can weather the storm.

– Nitin Motwani, managing partner of Miami Worldcenter Associates, developer of Miami Worldcenter and managing partner of Merrimac Ventures, whose recent projects include the Waldorf Astoria Residences Pompano Beach

What is your outlook for the South Florida real estate market in 2024 in terms of the economy’s impact and activity in different market segments?

Jeff Polashuk

Following the Federal Reserve’s recent announcement [of no interest rate increases in 2024], it is expected that home buyers will now have more confidence in the real estate market. With lower mortgage rates, consumers will be able to save on costs, and this will bring more people back to the market for buying homes. All of South Florida is expected to experience significant growth in the upcoming years. The region offers something for everyone, making it an attractive option for a wide range of people, including but not limited to families, couples and retirees. With its exceptional schools, stunning beaches, sunny weather and various entertainment opportunities, South Florida appeals to people all over the world.

– Jeff Polashuk, regional vice president, Compass Florida

The worst pain of the past on all levels is lessening. Rates are coming down, the insurance tort reform by the state is taking effect and bringing more insurance into the market. … We’re seeing rising inventory that will stabilize prices, and we’re encouraged that we’ll see a 10% to 15% rise in total home sales in 2024 because we’re coming off the bottom of the market. Historically, there’s a five-to-10 year run when you hit the bottom, and we believe that occurred over the last two years.

– Pappas, The Keyes Co.

hope the Florida Legislature will amend the Live Local Act with some fixes to make it easier for local governments to adopt the legislation and approve workforce and affordable deals. Hospitality will remain hot, with tourism reaching all-time highs, with no real slowdowns expected. I expect the continued migration of restaurants from the Northeast and Midwest to continue to South Florida, with a number of staples already being announced for 2024. Industrial deals will remain hot, with the amount of industrially zoned property shrinking.

– Schiller, Government Law Group

Bradley Colmer

Next year looks to be the year of financing — or, for some, when the bill finally comes due. While many developments have been approved, the next challenge will be securing capital for many of those developments and likely resetting expectations with the realignment of risk capital. While anticipated federal rate cuts should provide opportunities to secure better rates than what we are seeing today, getting through to banks who remain conservative, or who have troubled portfolios, will be a primary curve to navigate.

– Bradley Colmer, founder of Deco Capital Group, developer of Eighteen Sunset in Miami Beach

We’re already seeing that construction costs are coming down — and expect them to continue to decline — as many development projects have been significantly delayed or canceled altogether. Headed into 2024, I also think the upcoming election will create some expected uncertainty in the market, which will be helpful to eventually move past.

– Motwani, Miami Worldcenter Associates

Ryan Bailing

With companies, such as Citadel or Thoma Bravo, continuing to bring employees down here, I think 2024 is going to be a year of, how well do we absorb all of these folks that are moving in … not just in terms of having units for them to live in, whether they buy or they rent, but also having schools for them to go to and other infrastructure?

– Ryan Bailine, real estate partner at Greenberg Traurig

There’s been a massive trend toward branded residential … a number of Ritz-Carltons, St. Regis projects, Waldorf Astoria projects, a Rosewood project, Auberge project. They’re all coming down here. The Aston Martin building [in downtown Miami] has been under construction for a couple of years. That should deliver in the beginning of the year, and that’ll be a nice addition. We’ve got the Bentley building in Sunny Isles. So I think we’ll continue to see that. It helps distinguish the generic condo and sets an expectation of level of service that I think is important.

– Saul, Greenberg Traurig

I anticipate the trend toward wellness-focused amenities will continue, resulting in an increased emphasis on fitness centers, green spaces and recreational areas that promote health and well- being. Technology-driven “smart living” features will continue to gain traction. Similarly, I expect to start seeing specific innovations around parcel and food delivery make their way into the design of residential buildings and infrastructure.

– Jean-Francois (JF) Roy, founder and CEO of Ocean Land Investments, whose projects include a proposed residential tower connected to the Brightline train station in Fort Lauderdale

Asi Cymbal

Going into 2024, there will be continued focus on meeting housing demand for Florida’s workforce. The goal is to ensure our teachers, firefighters, police, emergency personnel, etc., don’t have to keep moving further from urban cores due to pricing. The anticipated federal rate cuts should inject a healthy dose of optimism into the South Florida real estate market this coming year. Even with banks continuing to be conservative in their underwriting, developers are standing on the sidelines, ready to hopefully obtain financing at more appetizing rates to get developments off the ground. It will be telling as to who can achieve this, as those with a successful track record and long-standing relationships will likely prevail.

– Asi Cymbal, chairman of Cymbal DLT Cos., whose residential development projects include Laguna Gardens in Miami Gardens and The Nautico District in Fort Lauderdale

Michael Troyanovsky

There is a growing demand for large condominium homes, often referred to as “vertical homes.” These homes offer the benefits and size of a single-family home, along with the amenities and services of a luxury condominium.

– Michael Troyanovsky, managing partner and vice president of marketing and sales at Regency Development Group, which is building La Maré in Bay Harbor Islands

If rate cuts materialize in 2024, this will further charge the local real estate market. Owners with recently completed projects seeking permanent financing and assets with loans maturing in this interest-rate environment will continue to find themselves in special situations or outright distress requiring recapitalizations, forced sales or even foreclosure. Notwithstanding these challenges, the liquidity available in the marketplace to take advantage of these special situations will serve to buoy any possibility of a precipitous drop in valuations.

– Leyva, Day Pitney

Due to the difficult capital markets environment, construction starts have decreased substantially compared to the last two years and will likely remain very low during the first half of 2024. Construction costs may start to decrease as contractors will have to start competing for fewer projects and material supply chains relax, bringing down material costs. As interest rates start declining, the combination of lower construction and lower financing costs will bring developers back to the table; therefore, we anticipate a re-acceleration in activity toward the later part of 2024.

Due to continued immigration and the strong local economy, we expect demand for housing to remain very elevated. However, due to large amounts of new unit deliveries in a few submarkets — e.g., Wynwood and Edgewater — we expect to see temporarily lower rent growth and concessions, especially in these submarkets. As the metro absorbs these units, the situation should normalize throughout 2025. Due to the lack of current construction starts, we expect rent growth to re- accelerate throughout 2025 and into 2026, which provides a positive backdrop for developers who can get projects started in 2024.

– Aregger, Empira

As a leading community bank, we see tremendous opportunity to grow in the commercial and industrial lending segment and in condo financing, as several associations are pursuing financing options for renovations and special assessments. As interest rates decrease, we also expect to see some incremental activity in the middle and lower end of the residential market.

– Garcia-Velez, Banesco

What are you most excited about for South Florida real estate in 2024?

I’m most excited for the ongoing migration of businesses and corporations moving to South Florida, and how the growth of their operations will continue to fuel our market.

– Motwani, Miami Worldcenter Associates

Cymbal DLT remains bullish on developing and embarking on new projects that encompass our pillars of sustainability, design and social quality. We expect to take advantage of interest rates coming down and finance close to $1 billion in 2024.

– Cymbal, Cymbal DLT

I am excited to address the workforce and affordability issues facing new and future residents and how our community is going to accept and come to a solution, because what we are doing now and have been doing for the last 20 years is not working.

– Schiller, Government Law Group

I look forward to seeing buyers taking increasing interest in eco-friendly experiences and community-centric spaces, such as sustainable architecture, co-working spaces, communal gardens and recreational areas that are designed to foster social interaction and well-being.

– Roy, OceanLand Investments

Miami is being transformed into a mixed-use super hub – including dynamic and modern office spaces, world-class retail and entertainment, and some of the most attractive housing globally. Some of the developments that are currently being planned and executed will continue to push Miami into becoming one of the world’s leading cities, which will keep attracting businesses and people into the city. For real estate developers like Empira, this backdrop provides the perfect canvas for continued large-scale investment.

– Aregger, Empira

I’m most excited to see South Florida complete its transition from an emerging growth city to a fully realized global destination. As a Miami local, I’ve seen the region evolve steadily over decades, and then the pandemic was a catalyst that accelerated all the pieces coming together on the world stage.

– Shear, PMG

Alejandro Arias

As an optimistic glance at 2024 seems to provide enhanced credence of interest rate cuts from the Federal Reserve and improved soft-landing prospects, and as global figures such as Ken Griffin and Jeff Bezos continue to flock to South Florida and call it home, I am truly excited to see the continued growth patterns in a multitude of sectors, from already resilient industrial, commercial and residential markets to enhanced global entertainment and restaurant concepts … making South Florida one of the premier destinations in the world.”

– Alejandro Arias, land-use partner at Holland & Knight LLP

The continued population growth consisting of wealthy foreigners escaping insecurity and political instability; retirees and high-income earners of all demographics, including young professionals from high-tax states from the Northeast, the Midwest and California; and the arrival of major employers like Citadel and Amazon will sustain South Florida for the foreseeable future. This will provoke a meaningful discussion on urban planning and transportation as South Florida accommodates this growth. I am very excited to watch Miami continue to grow into the next great American city, distinct from but in direct competition with the likes of New York, Chicago and San Francisco.

-Leyva, Day Pitney

The continued influx of not only blue-chip businesses and financial firms, but also international brands, luxury operators and taste-makers — and an ever-improving level of sophistication. The arrival of Audemars Piguet’s AP House, along with other brand offerings that are synonymous with world-class locations such as Paris, London, Tokyo, etc., illustrates that Miami is on the same path to becoming a leading global city.

– Colmer, Deco Capital Group

Just looking at how cities are being transformed. Pompano Beach has world-class buildings going up there. Related opened the first one with Casamar, but you’ve got the Ritz-Carlton Pompano coming. It’s just things that have never been there before. West Palm Beach has really not seen the type of development they’re seeing right now. Miami Worldcenter is a perfect example, because all that’s left really is the density of retail and restaurants for that area [of Downtown Miami]. … For a veteran like me who’s been in this town for a while, it’s really exciting to see.

– Saul, Greenberg Traurig

–Editing by Philip Shea.

Article Link: What They’re Saying About South Florida Real Estate

Author: Nathan Hale